End-to-end Invoice-to-Pay Automation with Agentic AI

Zai eliminates manual work across the invoice-to-pay lifecycle. It captures invoices from emails and vendor portals, performs advanced validations, matches POs, routes approvals, and triggers payments.

Seamlessly integrated with vendor onboarding, PO creation and reconciliation workflows, Zai enables a fully automated, compliant, and scalable accounts payable operation.

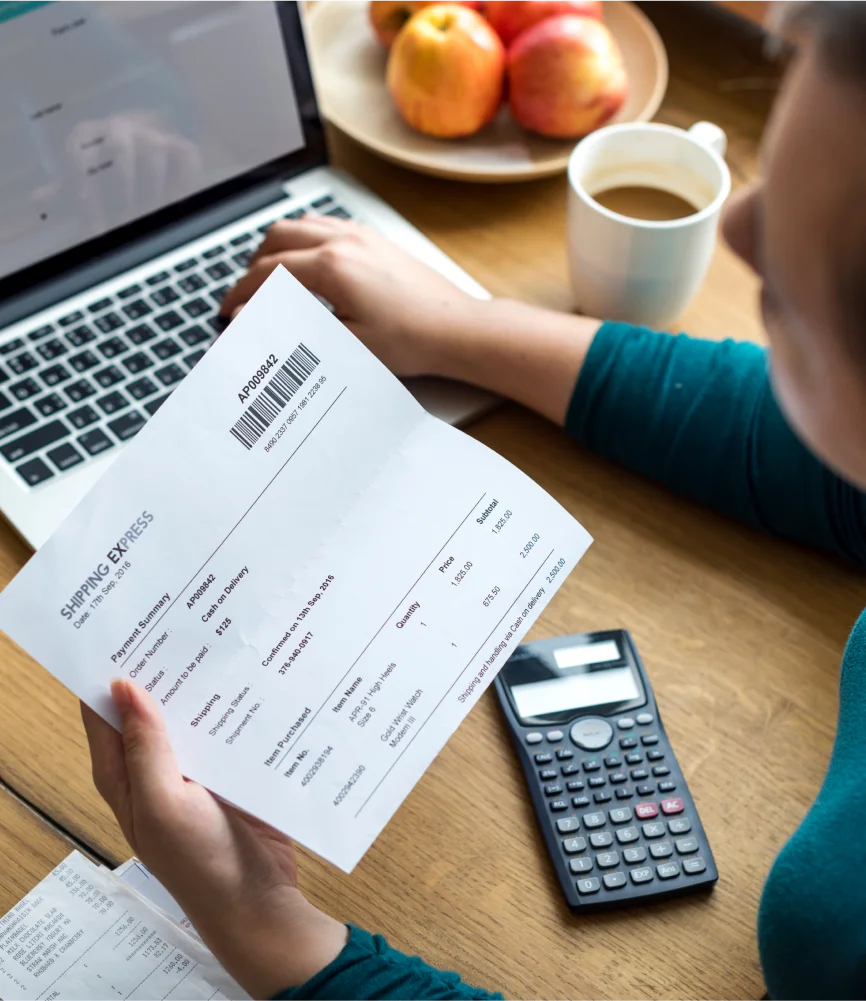

Drowning in high volume of invoices and struggling with efficiency?

The invoice to pay process often involves multiple sources of downloads, manual data entry, validations with government portals, vendor checks, and frequent back-and-forth. Many errors creep in. Approvals get delayed. Vendor trust takes a hit. Eventually it costs you much as twice per invoice.

What if every invoice — from the moment it arrives via email or vendor portal— could flow through your system intelligently, getting processed, validated, matched, and approved automatically with the help of AI?

That’s exactly what Zai Invoice-to-Pay makes possible.

The Invoice-to-Pay Problem Today

Invoices arrive from different sources — emails, portals, paper scans

Invoices have varying degree of formats and structures

Manual downloading, document sorting, and data entry consumes valuable time

GST verification, GRN matches, vendor validation, and compliance checks slow down the process

2-way and 3-way matches are still manual and prone to errors

Approvals get delayed, and payment cycles stretch longer than they should

The Invoice-to-Pay Problem Today

Invoices arrive from different sources — emails, portals, paper scans

Invoices have varying degree of formats and structures

Manual downloading, document sorting, and data entry consumes valuable time

GST verification, GRN matches, vendor validation, and compliance checks slow down the process

2-way and 3-way matches are still manual and prone to errors

Approvals get delayed, and payment cycles stretch longer than they should

Previous slide

Next slide

The Challenges of non-compliances and manual errors

Tax/Regulatory Mismatches leads to penalties

Duplicate/Fraud Invoices leading to Overpayments, fraud risk

Amount/Quantity Mismatches causes SLA holds, vendor disputes

Blocked Budgets & GRN Pending causes Delayed payments, vendor dissatisfaction

Discover Your Cost Saving Potential With Zvolv

Receive a customized comparison of total ownership costs and launch timelines specific to your process. Imagine the possibilities with the time and money you’ll save.

Zvolv's Advantages Over Legacy Invoice Processing Systems

Zvolv overcomes the inherent limitations of legacy tools like SAP OpenText VIM, offering a modern, intelligent, and agile solution specifically designed for the complexities of the Indian market.

Unlike the long, complex, and expert-heavy implementation cycles of legacy systems, Zvolv offers a rapid and simplified deployment.

Our low-code platform can be launched in weeks, eliminating the need for deep technical expertise and heavy customization, making it ideal for enterprises of all sizes.

Where legacy OCR struggles with diverse Indian invoice formats and delivers low accuracy (often <50%), Zvolv’s advanced AI achieves significantly higher out-of-the-box accuracy.

This minimizes rework, reduces delays, and ensures reliable data capture from the start.

Zvolv automates the entire exception handling process, dramatically increasing the straight-through processing rate far beyond the typical 30%-40% seen in legacy systems.

Our intelligent workflows automatically identify, route, and resolve discrepancies, freeing your AP team from manual, repetitive tasks.

We replace outdated and unintuitive interfaces with a clean, modern, and user-friendly experience.

This ensures rapid user adoption, minimizes training time, and empowers your AP teams to handle tasks and exceptions more efficiently.

Zvolv empowers your business users to create and modify approval rules with an intuitive, drag-and-drop interface.

This removes the dependency on IT for workflow maintenance, ensuring that organizational changes are reflected instantly and preventing misrouted invoices.

Built on a modern, cloud-native architecture, Zvolv is designed to scale effortlessly.

It consistently performs at a high level, even during peak processing periods, eliminating the backlogs and latency common in legacy systems.

As a SaaS platform, all upgrades are managed seamlessly by Zvolv without disrupting your operations or breaking custom configurations.

We ensure your processes remain continuously compliant with the latest evolving GST and e-invoicing regulations, mitigating risk.

Zvolv's Advantages Over Legacy Invoice Processing Systems

Zvolv overcomes the inherent limitations of legacy tools like SAP OpenText VIM, offering a modern, intelligent, and agile solution specifically designed for the complexities of the Indian market.

- Rapid & Simple Implementation

Unlike the long, complex, and expert-heavy implementation cycles of legacy systems, Zvolv offers a rapid and simplified deployment.

Our low-code platform can be launched in weeks, eliminating the need for deep technical expertise and heavy customization, making it ideal for enterprises of all sizes.

- Superior AI-Powered Data Capture

Where legacy OCR struggles with diverse Indian invoice formats and delivers low accuracy (often <50%), Zvolv’s advanced AI achieves significantly higher out-of-the-box accuracy.

This minimizes rework, reduces delays, and ensures reliable data capture from the start.

- Intelligent, Automated Exception Handling

Zvolv automates the entire exception handling process, dramatically increasing the straight-through processing rate far beyond the typical 30%-40% seen in legacy systems.

Our intelligent workflows automatically identify, route, and resolve discrepancies, freeing your AP team from manual, repetitive tasks.

- Modern and Intuitive User Experience

We replace outdated and unintuitive interfaces with a clean, modern, and user-friendly experience.

This ensures rapid user adoption, minimizes training time, and empowers your AP teams to handle tasks and exceptions more efficiently.

- Agile & Business-Owned Workflows

Zvolv empowers your business users to create and modify approval rules with an intuitive, drag-and-drop interface.

This removes the dependency on IT for workflow maintenance, ensuring that organizational changes are reflected instantly and preventing misrouted invoices.

- Seamless Scalability

Built on a modern, cloud-native architecture, Zvolv is designed to scale effortlessly.

It consistently performs at a high level, even during peak processing periods, eliminating the backlogs and latency common in legacy systems.

- Effortless Upgrades & Guaranteed Compliance

As a SaaS platform, all upgrades are managed seamlessly by Zvolv without disrupting your operations or breaking custom configurations.

We ensure your processes remain continuously compliant with the latest evolving GST and e-invoicing regulations, mitigating risk.

Previous slide

Next slide

Why Indian Enterprises are moving beyond SAP VIM with Zvolv’s AI-Driven Automation ?

Ensuring Invoices compliance and validations

Zvolv ensures that the key aspects of all compliances needed for the invoice are handled including:

PO Compliances

GST and PAN Validations

IRN Validations

Vendor Master Database Validations

HSN/SAC Code Validations

E-Way Bill Compliance

Bank Account Validations

UDYAM MSME Validation

These thorough checks ensure no fraud slippage as well as much needed compliances in process.

Zai Value and Gap Coverage

Invoice Receipt & Capture

Invoice Receipt & Capture

Jobs To Be Done

- Receive invoices from multiple channels

- Digitise and extract data accurately

- Ensure no invoice is missed

Common Challenges

- Paper/Email invoices lost or delayed

- OCR misreads key fields

- Multiple formats cause manual entry

Value Delivered

- AI-powered capture from all channels

- High-accuracy extraction with auto-flag for low confidence fields

- Inconsistent format handling; near-touchless capture

Validation & Compliance Checks

Validation & Compliance Checks

Jobs To Be Done

- Validate mandatory fields (e.g. IRN, GSTIN)

- Check for duplicates

- Verify tax/regulatory compliance

Common Challenges

- Duplicate invoices not flagged

- Wrong GSTINs or tax IDs

- Missing mandatory data fields

Value Delivered

- Real-time validation using intelligent rules

- Fuzzy matching to detect duplicates

- Automated GST/TDS validation & compliance

Matching & Approval

Matching & Approval

Jobs To Be Done

- Match invoices to POs & GRNs (2/3-way)

- Auto-approve clean matches

- Route non-PO invoices for approval

Common Challenges

- Price/quantity mismatches

- Missing PO references

- Non-PO invoices needing manual approval

Value Delivered

- Smart AI matching engine with feedback learning

- Tuned auto-approval rules

- Dynamic approval routing for mismatches and Non-PO invoices

Exception Handling

Exception Handling

Jobs To Be Done

- Diagnose root causes

- Route to appropriate stakeholder

- Ensure quick resolution of mismatches

Common Challenges

- Price/Qty discrepancies

- Missing GRNs

- Incorrect vendor/tax data

Value Delivered

- Root cause analysis by AI (e.g. GRN or vendor issues)

- Automated routing based on context/SLA

- Resolution tracking and automated data updates

Payment Scheduling & Execution

Payment Scheduling & Execution

Jobs To Be Done

- Schedule payments as per terms

- Optimise for cash flow/discounts

- Ensure timely & accurate payments

Common Challenges

- Late payments and trust issues

- Missed early payment discounts

- Wrong payment account details

Value Delivered

- AI-driven payment scheduler aligned to payment terms

- Dynamic discount optimisation engine

Previous

Next

Eliminate manual tasks

Process invoices faster and more accurately with compliance checks built in

Strengthen vendor relationships with timely payments

Gain complete visibility and control over your AP process

Set up cost efficient AP team with significantly higher RoI and speed operations

Zai Invoice-to-Pay —

The

Intelligent Automation

Engine for Finance Teams.

Zai doesn’t just automate — it transforms.

It becomes your always-on intelligent assistant,

streamlining the full invoice-to-pay cycle so you can.

Eliminate manual tasks

Process invoices faster and more accurately with compliance checks built in

Strengthen vendor relationships with timely payments

Gain complete visibility and control over your AP process

Set up cost efficient AP team with significantly higher RoI and speed operations

Zai Invoice-to-Pay — The Intelligent Automation Engine for Finance Teams.

Zai doesn’t just automate — it transforms. It becomes your always-on intelligent assistant, streamlining the full invoice-to-pay cycle so you can.

The Zai Invoice-to-Pay Flow: From Inbox to Payment — All in One Intelligent Flow

Smart Invoice Intake from Email and Other Channels

- Automatically ingest invoices sent to a shared email inbox — no manual download or upload required

- Seamlessly process invoices from vendor portals and manual uploads

- Auto-detect formats (PDF, Excel, image scans) and extract key details: vendor name, GSTIN, HSN/SAC Codes, invoice number, date, line items, taxes applicability. No more cluttered inboxes or manual intervention. Invoices flow directly from email into Zai’s intelligent processing engine.

Intelligent Validation & GST Verification

- Real-time validation of vendor GSTIN, HSN/SAC Codes and PAN with government databases

- Policy-based checks for invoice terms, duplicate detection, and data consistency including anomaly detections

- Instant anomaly flagging and exception alerts

Automated 2-Way and 3-Way Matching

- Seamless matching of invoices with purchase orders and goods receipts

- Automated variance checks and discrepancy alerts

- Exception-based routing for resolution without manual intervention

Smart Approval Workflows

- Configure approval paths based on invoice values, business units, or vendor categories

- Auto-escalation and reminder triggers to keep the process moving

- Full visibility into approval cycle times and bottlenecks

Payment Readiness & ERP Integration

- Payment file generation after all validations and approvals

- Seamless integration with ERP and banking systems for effortless disbursals

- Complete audit logs for compliance and reporting

Continuous Optimization with Zai

- Zai learns from every invoice cycle and reduces future exceptions

- Recommends process improvements and identifies vendor or category-level patterns

- Grows smarter as your business rules evolve

Previous

Next

The Zai Invoice-to-Pay Flow: From Inbox to Payment — All in One Intelligent Flow

Smart Invoice Intake from Email and Other Channels

- Automatically ingest invoices sent to a shared email inbox — no manual download or upload required

- Seamlessly process invoices from vendor portals and manual uploads

- Auto-detect formats (PDF, Excel, image scans) and extract key details: vendor name, GSTIN, HSN/SAC Codes, invoice number, date, line items, taxes applicability. No more cluttered inboxes or manual intervention. Invoices flow directly from email into Zai’s intelligent processing engine.

Intelligent Validation & GST Verification

- Real-time validation of vendor GSTIN, HSN/SAC Codes and PAN with government databases

- Policy-based checks for invoice terms, duplicate detection, and data consistency including anomaly detections

- Instant anomaly flagging and exception alerts

Automated 2-Way and 3-Way Matching

- Seamless matching of invoices with purchase orders and goods receipts

- Automated variance checks and discrepancy alerts

- Exception-based routing for resolution without manual intervention

Smart Approval Workflows

- Configure approval paths based on invoice values, business units, or vendor categories

- Auto-escalation and reminder triggers to keep the process moving

- Full visibility into approval cycle times and bottlenecks

Payment Readiness & ERP Integration

- Payment file generation after all validations and approvals

- Seamless integration with ERP and banking systems for effortless disbursals

- Complete audit logs for compliance and reporting

Continuous Optimization with Zai

- Zai learns from every invoice cycle and reduces future exceptions

- Recommends process improvements and identifies vendor or category-level patterns

- Grows smarter as your business rules evolve

Previous

Next

What This Means for Your Business?

Email-to-ERP invoice flow, fully automated

Eliminate manual downloading, sorting, and data entry.

60–75% reduction in manual effort

Free your team to focus on strategic finance initiatives.

Faster invoice processing and approvals

Achieve quicker month-end closures and on-time vendor payments.

Improved accuracy and compliance

Real-time GST verification, duplicate detection, and audit-readiness.

Transparent, real-time control

Full visibility into processing stages and bottlenecks.

Scalability across geographies and business units

A solution that grows with you — Zai adapts to evolving business needs.

Email-to-ERP invoice flow, fully automated

Eliminate manual downloading, sorting, and data entry.

60–75% reduction in manual effort

Free your team to focus on strategic finance initiatives.

Faster invoice processing and approvals

Achieve quicker month-end closures and on-time vendor payments.

Improved accuracy and compliance

Real-time GST verification, duplicate detection, and audit-readiness.

Transparent, real-time control

Full visibility into processing stages and bottlenecks.

Scalability across geographies and business units

A solution that grows with you — Zai adapts to evolving business needs.

What This Means for Your Business?

Email-to-ERP invoice flow, fully automated

60–75% reduction in manual effort

Faster invoice processing and approvals

Improved accuracy and compliance

Transparent, real-time control

Scalability across geographies and business

Email-to-ERP invoice flow, fully automated

Eliminate manual downloading, sorting, and data entry.

60–75% reduction in manual effort

Free your team to focus on strategic finance initiatives.

Faster invoice processing and approvals

Achieve quicker month-end closures and on-time vendor payments.

Improved accuracy and compliance

Real-time GST verification, duplicate detection, and audit-readiness.

Transparent, real-time control

Full visibility into processing stages and bottlenecks.

Scalability across geographies and business

A solution that grows with you — Zai adapts to evolving business needs.

Cost Efficiency

- For mid-scale operations which involve processing ~100K invoices per year, Zvolv can save upwards of 25 Lakh per year

- For high scale operations involving 250K + invoices, Zvolv can save upwards of 60 Lakh per year

Value Realization for CFO

- The Enterprise can aim to reduces operational costs by 60% and get to RoI Realisation within one quarter.

- The Account Payable team gets reduced by 70% while improving efficiency and vendor satisfaction.

Why Zai?

- Built for Finance Teams: Designed for ease of use with finance-first logic

- Intelligent Email Intake: Directly capture invoices from email inboxes without manual handling

- Agentic AI That Learns: Continuously evolves and adapts to your policies and business rules

- Fast Deployment: Go live in weeks, not months

- Secure and Scalable: Enterprise-grade security, built to scale with global operations

Previous

Next

Cost Efficiency

- For mid-scale operations which involve processing ~100K invoices per year, Zvolv can save upwards of 25 Lakh per year

- For high scale operations involving 250K + invoices, Zvolv can save upwards of 60 Lakh per year

Value Realization for CFO

- The Enterprise can aim to reduces operational costs by 60% and get to RoI Realisation within one quarter.

- The Account Payable team gets reduced by 70% while improving efficiency and vendor satisfaction.

Why Zai?

- Built for Finance Teams: Designed for ease of use with finance-first logic

- Intelligent Email Intake: Directly capture invoices from email inboxes without manual handling

- Agentic AI That Learns: Continuously evolves and adapts to your policies and business rules

- Fast Deployment: Go live in weeks, not months

- Secure and Scalable: Enterprise-grade security, built to scale with global operations

Previous

Next

How does Zai help CFO win?

Financial Impact

- 20–30% reduction in overpayments

- Over 60% operational costs saved

- Over 50% efficiency gains

Operational Impact

- 50–70% SLA breach reduction

- 60–80% manual efforts reduction

Vendor Impact

- Faster Invoice Processing with better exception handling

- Faster dispute resolution

- Improved Vendor Satisfaction

See Zai Invoice-to-Pay In Action

Watch how invoices move from your email inbox through validations, matching, approvals, and payment readiness without manual intervention

Watch how invoices move from your email inbox through validations, matching, approvals, and payment readiness without manual intervention

Learn from case studies of companies like yours

Learn from case studies of companies like yours

Understand how Zai fits into your ERP and banking systems

Understand how Zai fits into your ERP and banking systems

FAQs

The Invoice-to-Pay (I2P) cycle is the complete business process that begins when your company receives an invoice from a vendor and ends with the final payment being made and recorded. Also known as the Procure-to-Pay (P2P) cycle, it is the core function of your Accounts Payable (AP) team.

- Significant Cost Savings: Drastically reduce operational costs by eliminating manual data entry and preventing late payment fees.

- Enhanced Financial Control: Gain real-time visibility and control with digital audit trails and automated policy enforcement.

- Improved Vendor Relationships: Become a preferred partner by ensuring accurate and timely payments.

- Increased Productivity: Free your AP team to focus on strategic, high-value activities.

Your ERP (like Tally, SAP, or Oracle) is your system of record for financial data. An AP automation platform is a system of workflow and intelligence. It sits on top of your ERP, handling the complex, real-world challenges of invoice processing—like reading different formats, managing approvals, and ensuring tax compliance—before feeding clean, verified, and approved data into your ERP.

Absolutely. Our system uses advanced Optical Character Recognition (OCR) and AI that is format-agnostic. It doesn’t rely on fixed templates. The AI is trained to understand the context of an invoice, so it can accurately identify and extract key information—like invoice number, date, amount, and GST details—from a wide variety of layouts, structures, and even scanned images of physical documents.

Our platform guarantees very high accuracy, typically over 95% “straight-through” processing without human intervention. For the small percentage of invoices that the AI might flag for low confidence (e.g., due to a poor quality scan or a completely new format), it routes them to a human for quick verification. The system then learns from these corrections, becoming even more accurate over time.

Our platform is built to handle the complexities of the Indian GST regime. It automatically:

- Validates GSTIN: Checks the vendor’s GSTIN against the official government portal to ensure it is active and valid.

- Verifies HSN/SAC Codes: Matches HSN/SAC codes on the invoice to your master data.

- Calculates GST: Cross-checks the CGST, SGST, and IGST calculations on the invoice to prevent errors and ensure you can claim the correct Input Tax Credit (ITC).

AP automation transforms the audit process from a disruptive, time-consuming task into a streamlined, efficient verification. Key benefits include:

- Complete Digital Audit Trail: Every action on an invoice—from receipt and data extraction to approval and payment—is electronically time-stamped with the user’s details. This creates an immutable, easy-to-follow record for auditors.

- Centralized Document Access: Auditors no longer need to request physical documents. The invoice, PO, GRN, contracts, and all internal communication are stored digitally and linked together, accessible in a single click.

- Automated Policy Enforcement: The system ensures that your internal controls (like approval limits and segregation of duties) are automatically enforced. This proves to auditors that your policies are being followed in practice, not just on paper.

- Faster Evidence Retrieval: You can provide auditors with read-only access to the system, allowing them to pull their own samples and review evidence instantly. This drastically reduces the time and effort your team spends on audit support.

- Enhanced GST Audit Readiness: With automated validation of GSTINs and IRNs, and a clear link between invoices and their corresponding GSTR-2B entries, GST audits become significantly simpler and the risk of non-compliance penalties is greatly reduced.

Yes. For businesses under the e-invoicing mandate, this is a critical function. The system can:

- Scan QR Codes: Automatically read the digitally signed QR code on an e-invoice to capture key details.

- Verify IRN: Validate the 64-character Invoice Reference Number (IRN) against the government’s Invoice Registration Portal (IRP) to confirm the invoice is authentic and has been officially registered. This is crucial for claiming ITC.

This is a core strength of the system. We automate the 3-Way Match process:

- Purchase Order (PO): The system pulls the PO data from your ERP.

- Goods Receipt Note (GRN): It matches the invoice against the GRN to confirm that the goods or services were actually received.

- Invoice: The invoice from the vendor is the final piece.

The platform automatically compares the quantities, prices, and totals across all three documents. If they match, the invoice is cleared for payment. If not, it’s automatically flagged as an exception for human review.

Yes, security is our top priority. We use robust, enterprise-grade security measures, including end-to-end data encryption, and our platforms comply with global security standards like ISO 27001 and SOC 2.

While this varies, a standard implementation can be completed within a few weeks to a couple of months. We provide a dedicated manager to ensure a smooth transition and comprehensive training for your team.

Most customers go live within 4–6 weeks

We offer seamless, bi-directional integration with a wide range of ERPs and accounting systems commonly used in India and globally, including:

- Tally (Prime & ERP 9)

- SAP (S/4HANA & ECC)

- Oracle (NetSuite & Fusion)

- Microsoft Dynamics 365

- Zoho Books & QuickBooks

Integration ensures that your vendor master, PO data, and final payment entries are always in sync between both systems without any manual effort.

We also ensure custom Integrations throughAPI-based and file-based integrations to fit your IT landscape.

No, ZAi does not directly connect to banking systems or initiate payments through banking APIs. Instead, ZAi can generate a bank payment instruction letter in the required format, which can be securely uploaded into your banking portal to trigger payments. This ensures your existing secure banking processes remain intact, while ZAi automates invoice processing, compliance checks, reconciliation, and payment readiness.

No, ZAi does not directly connect to banking systems or initiate payments through banking APIs. Instead, ZAi can generNo. ZAI works alongside your existing systems. Your master data can remain in your ERP or accounting platform — we integrate to read/write as needed.ate a bank payment instruction letter in the required format, which can be securely uploaded into your banking portal to trigger payments. This ensures your existing secure banking processes remain intact, while ZAi automates invoice processing, compliance checks, reconciliation, and payment readiness.

You can continue using your current accounting software. ZAI will connect with it for data exchange, automation (STP), and reconciliation.

ZAI can integrate with banking platforms for reconciliation and payment status tracking. Direct payment initiation via banking APIs is not currently supported.

No. Users can work entirely within Zvolv’s interface for invoice-to-pay workflows, while data is synchronised with your ERP in the background.

Key success metrics include reduced invoice processing time, high straight-through processing (STP) rates, improved accuracy, zero compliance breaches, and measurable reduction in AP costs.

Absolutely. Zvolv’s dynamic workflow engine lets you configure rules based on value thresholds, vendor categories, cost centres, and multi-level approvals.

We offer guided onboarding, training sessions, and continuous support. Our change management framework includes stakeholder alignment, pilot runs, user training, and phased rollout.

ZAI routes non-PO invoices through configurable approval workflows with validations for vendor, tax, and compliance before posting to your ERP for payment readiness.

Yes. Our ICR (AI-OCR) technology can extract data from handwritten invoices, subject to legibility. Accuracy improves further with our human-in-the-loop review.

Unlike traditional OCR or RPA systems that require template configuration for each format, ZAI focuses on the information required from the invoice rather than its layout. It intelligently extracts the necessary details regardless of format, ensuring accuracy without additional setup.

No. ZAI requires invoices to be provided as individual files. If invoices are received in a ZIP file, they need to be extracted before being uploaded or processed by ZAI.

Yes. ZAI supports multi-currency processing with automatic FX conversion based on configured rates, and applies relevant tax and regulatory validations.

ZAI ensures compliance through multi-layered automated validations covering POs, GRNs/MRNs, vendor verification, invoice structure, and mandatory field checks. It detects duplicates and potential fraud, validates calculations, rates, quantities, and taxes against POs, and enforces approval authority limits. Statutory requirements like GSTIN format, HSN/SAC codes, applicable tax rates, E-Way Bill rules, and e-Invoice/IRN validations (including QR codes) are built in. All actions are logged for secure and transparent operations. These controls are continuously updated to reflect changing regulatory and business requirements,and reducing compliance risks.

Yes. ZAI is designed to align with IT General Controls, including access management through (SSO, ABAC & RBAC), change management, and operational controls.

ZAI is built on enterprise-grade security with encryption at rest and in transit, role-based access, and audit logging. No customer data is used to train public LLMs.

ZAI uses large language models like ChatGPT and Google Gemini only under secure enterprise licenses, which guarantee that your data is not stored, used for training, or exposed to the public. All processing occurs in controlled, compliant environments with encryption in transit and at rest, and access restricted to authorized users. Zvolv’s infrastructure and processes are aligned with SOC 2 and ISO 27001 standards, ensuring sensitive financial and operational information remains private and fully under your organisation’s control.

ZAI automatically flags duplicate invoices using multi-parameter matching (invoice number, vendor, date, amount, PO reference).

ZAI is intuitive and requires minimal training. Most users become productive in under a week with our guided on boarding.

ZAI can be deployed on-cloud or on-premise, depending on your IT policy. Security controls include encryption, role-based permissions, and SOC2-aligned processes.

ZAI is designed for quick adoption, with a modern UI, contextual help, and minimal clicks to complete tasks.

Our team provides a structured change management plan covering stakeholder, phased deployment, training, and continuous support.

From email intake to payment readiness — faster, smarter, and more accurate.Let Zai simplify and accelerate your invoice-to-pay process today.

Client Testimonials

“Our finance team reduced processing effort by over 65%. Zai’s automated email intake and intelligent matching have completely transformed how we handle invoices.”

Finance Director, Leading Retail Chain

“What used to take days now happens in hours. From email capture to payment readiness, Zai has made our AP process intelligent and effortless.”

Head of Finance Operations, Global Manufacturing Firm

Previous

Next